Investment in infrastructure development is set to be one of the main drivers of sustainable growth in emerging markets as the COVID-crisis subsides, according to sigma and research carried out by the Journal

According to half of those polled in the survey, conducted by The Journal in November 2020, it could take one to two years for the engineering and construction sector to fully recover from the impact of COVID-19. Thirty-eight percent were more optimistic and thought activity would pick up again in the latter half of 2021, while 13% thought the challenging headwinds could impact the industry for two years or more.

Asia Pacific is the region expected to benefit most from an uptick in infrastructure development, followed by the Middle East and North Africa, according to respondents. “New projects are fully dependent upon governmental support,” said the director of global insurance of an engineering company, based in Asia. “Sector support to invest in maintenance projects (US and Europe) would help at this time.”

Hardening insurance market

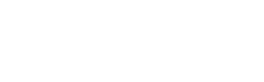

The hardening insurance market could prove a challenge as activity picks up, with 63% of engineering and construction risk managers saying they had experienced challenges securing insurance cover over the past 12 months. This was either because insurance was ‘too expensive’ or because ‘capacity for specific cover is not available’.

“Whilst government stimulus packages will assist the creation of additional construction projects and thereby bring more premium into the pool, the current sentiment from underwriters is too cautious and there does not appear to be any ambition to grow in this space,” said an insurance lead.

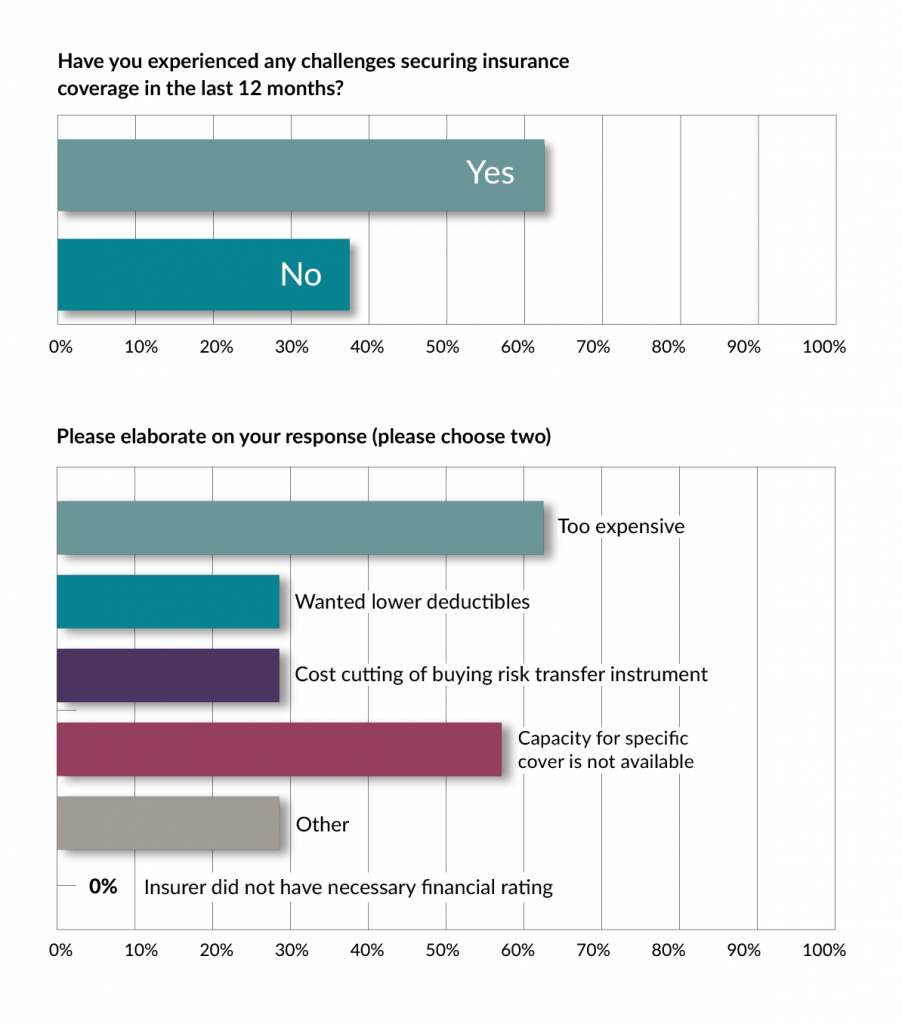

When asked what they thought had driven the hardening insurance market for engineering and construction risks, respondents identified a ‘reduction in capacity for CAR/EAR and other coverages’ along with ‘insufficient profitability of insurers in this segment’. ‘Market performance reviews’ and a ‘worsening claims experience’ were cited as other factors.

In terms of choosing an insurance partner, risk and insurance managers said price and claims paying ability are the top two criteria.

Asked how new technologies were driving efficiencies in project management, respondents noted design and project control was becoming more and more data-driven, with larger projects utilising business information modelling (BIM 2.0). “The use of these technologies in project management should be included in evaluating specific exposures,” thought a Philippines-based risk manager.

The findings of the survey are backed up by a recent sigma report: Power up: investing in infrastructure to drive sustainable growth in emerging markets. In particular the prediction that infrastructure recovery will be quickest in Asia Pacific and MENA and the importance of fiscal stimulus to help cushion the negative impacts of the COVID-19 pandemic.

sigma estimates that the largest share of the estimated investment in emerging markets will be in energy infrastructure (34%), with a core focus on renewable energy. Building and upgrading of existing infrastructure to become more resilient to climate change impacts will also be a key area of sustainable investment.

Sigma expects emerging Asia to build most new infrastructure over the next 20 years, with annual investment of $1.7 trillion (4.2% of regional GDP). Africa, meanwhile, is expected to invest 4.3% of regional GDP in infrastructure annually up to 2040. Sector-wise, most investment with be in energy, followed by road. China, which is also due to invest heavily in rail infrastructure, will be the biggest contributor.

Against the backdrop of the pandemic, risk of trade war and a credit crisis, public policy should focus on sustainable infrastructure development and inclusive growth, according to Jerome Jean Haegeli, group chief economist at Swiss Re.

“Spending on infrastructure could be one of the ways to kickstart parts of the economy after the COVID-19 pandemic and help drive strong and sustainable growth over the next decade,“ said Jerome Jean Haegeli, Group Chief Economist at Swiss Re. “Most infrastructure spending will be in emerging Asia, which we also expect to be the engine of global economic growth.“

“The realities of today, including an increasingly pervasive digital technology, the clear impact of climate change and the need to build more resilient societies, will increase demand for, and shape the direction of, infrastructure development in emerging markets,“ Haegeli said.