‘One of the most complex losses in recent history’

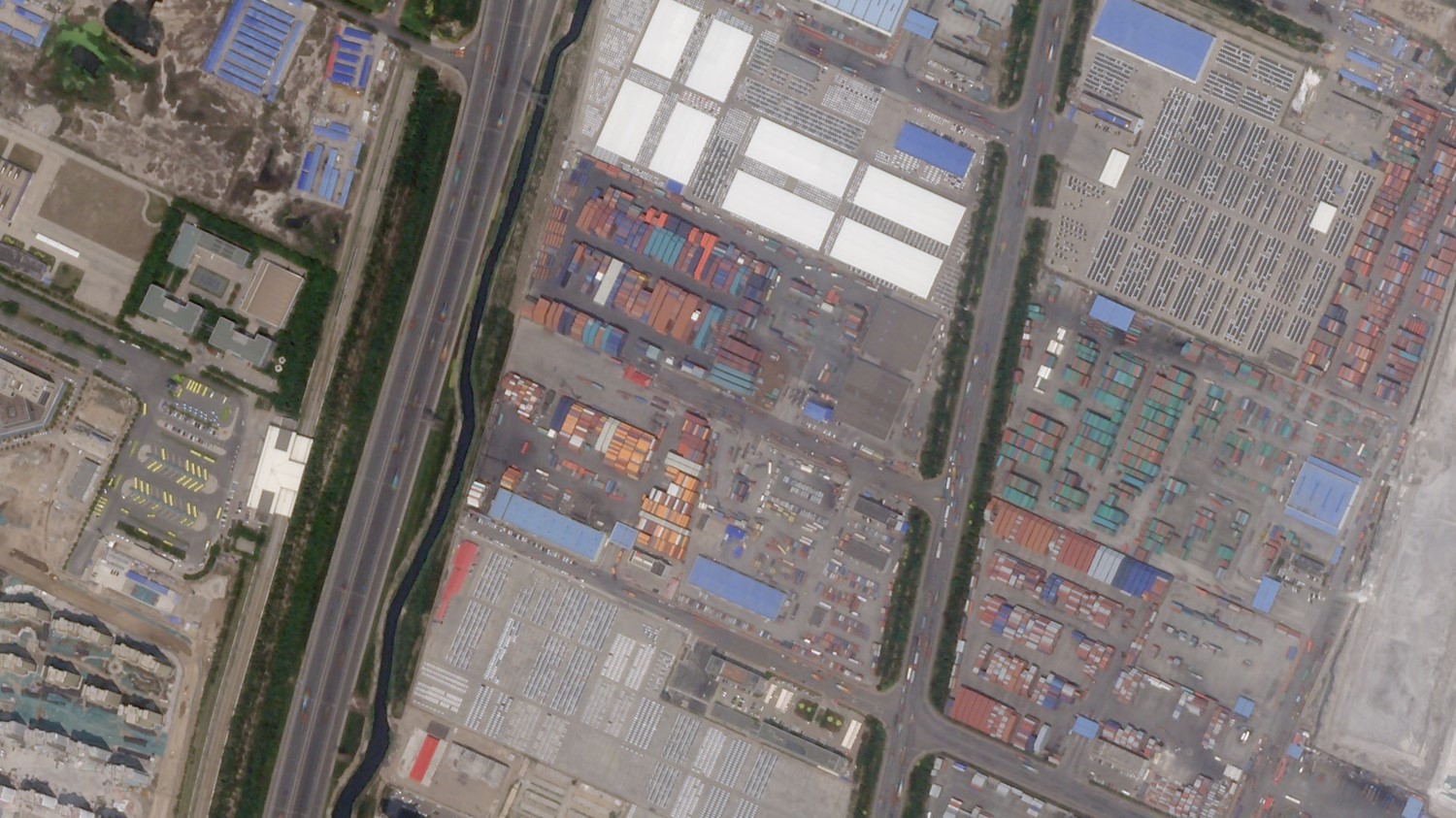

August 12, 2015, two massive explosions rocked the north-east Chinese port city of Tianjin, home to 15 million people. They left behind an enormous crater and caused an inferno that damaged and destroyed warehouses, containers and thousands of cars. The explosions devastated a vast area of the port – at the time the tenth largest and sixth busiest in the world.

The warehouse at the centre of the blast stored hundreds of tons of hazardous chemicals and sodium cyanide was found as far as 1km from the site. Hundreds of local residents were evacuated and a 3km exclusion zone was imposed. The death toll was eventually counted at 173, with more than 700 injured.

Crawford Global Technical Services (GTS) adjusters were on the scene shortly after the incident occurred and continue to handle claims to this day for many multinational corporate clients and insurers from both the Chinese and Japanese market. The adjusters were able to get a reasonable feel for the extent of damage sustained from outside the exclusion zone, which included many uninsured private apartment buildings.

A huge challenge came from multinational and local manufacturing facilities within the five-mile blast band. They suffered damage from the explosions’ shock-waves, such as broken windows and distortion to external walls, roof panels and other structural elements. Escape of water claims occurred from ruptured sprinkler systems, which production machinery was severely shaken, requiring repair/recalibration.

However, with factory closures and supply chain disruption caused by environmental safety concerns relating to toxic gases, it was the business interruption issues that would have the most lasting effects.

Noxious chemicals and restricted access

The adjusters were allowed inside the exclusion zone by August 25. Risk managers of Crawford & Company’s multinational accounts had been contacted immediately after the explosion happened, and they were briefed regarding the situation and their potential exposures. Several of them had cargo passing through the port (including around 10,000 new vehicles) and our inspections revealed what, for many, became a total loss.

The warehouse devastated by the explosions was eventually discovered to have contained “over 40 kinds of hazardous chemicals”, according to police spokespeople, including sodium cyanide in quantities well above what was permitted. In addition, ammonium and potassium nitrate were present in large quantities, with investigators concluding that this, in combination with the highly volatile gas acetylene, may have caused the detonation.

The Chinese authorities have since conducted an investigation that has resulted in significant tightening of the regulations around hazardous materials. The result has been a slow down for businesses using the port due to strict licensing issues, meaning any business involved in chemicals will now have to jump through considerably more hoops than before.

Licences have had to be re-applied for under a much stricter regime, which from an operational standpoint has created a bottleneck for businesses importing raw materials or using the port; they have had to find workaround solutions that are often much slower or more expensive.

Different opinions

Local laws involve a fronting insurer in China, which means that despite the fact that there is very little retention in the local market, there is an assumption that the claim must be adjusted based on a local understanding, even if reinsurers or captives have a different opinion about how the policy should operate.

A good example of how this can create problems can be seen with one claim in which a company was not covered for business interruption; instead, it had an endorsement for increased costs of working. It wasn’t covered for business losses, but it was covered for costs to mitigate any potential losses. This was always the intention of the local Chinese insurers, which said that you can’t have increased costs of working without normal gross profit cover. This led to the conclusion there shouldn’t be any payment made if the loss had already been mitigated by increased costs of working cover.

Another example was an organisation with raw materials on the dock that were destroyed. It didn’t have any physical damage at its manufacturing facility, but it couldn’t import materials without sourcing from an alternative port; this cost a lot of money. Because the port then didn’t reopen, the organisation had to continue incurring this additional cost. After the replacement of the damaged stock, there was no cover for the continuation of that supply from the alternative port. There was no ‘damage to property’ trigger in the loss, and while the organisation believed it had plenty of increased cost of working cover, because the loss didn’t flow from damage to its insured property, it wasn’t entitled to a payment.

The explosions that occurred in Tianjin are likely to constitute one of the largest insured man-made losses to date in Asia. It will certainly be considered one of the most complex insurance and reinsurance losses in recent history. It is probably a fair bet that the operation of Tianjin will never return to its full pre-loss capacity because of the restrictions placed on what can be moved and stored there. This could cause overreaching issues for manufacturers in the area, changing their business models forever.

Images supplied by Planet www.planet.com